What is IFTA? 12 Things You Need to Know

Fuel taxes can make truckers’ lives complicated. But there is a way to streamline all that paperwork.

IFTA – or the International Fuel Tax Agreement – is a way to simplify how truckers and trucking companies pay their fuel taxes. In the past, paying fuel taxes was a time-consuming affair that required truckers to stop at a port of entry to buy a permit.

Since time is money (especially in trucking), a few states hammered out an agreement in the early 80s to create a permit that would be honored in all of them. Eventually, all of the lower 48 states plus 10 Canadian provinces decided to participate. Alberta was the first Canadian province to join – not even all of the U.S. was on board, with only 21 states signed on at the time. Alaska and Hawaii are still not participants at this time – and we obviously don’t expect much interstate trucking involving Hawaii.

The revenues collected help maintain the roadways that we all depend on. And heavy commercial vehicles are a major source of wear and tear on those roads.

How Drivers Benefit from IFTA

We can all agree that few truck drivers got into their profession because they love paperwork. Ultimately, the agreement means drivers need to worry a lot less about tax paperwork. They’ll save time. They’ll find it easier to remain in compliance. And they’ll make fewer errors.

Before the agreement, truckers and trucking companies had to deal with multiple jurisdictions to pay fuel taxes. Some of the regulations were even contradictory, which created stress for all involved. They had to buy fuel tax licenses for any state they traveled through. By switching to a single permit, truckers simplified their paperwork.

They also save money: Temporary permits vary in length, and the piecemeal approach to purchasing them can quickly cost more than paying the fee your home state charges for a fuel tax license.

How Does IFTA Work?

Drivers are required to track how much fuel they use and how far they drive in each jurisdiction (states, territories, and provinces, as applicable). The business reports this information quarterly, and member jurisdictions share the tax revenue accordingly.

That’s good news for the member jurisdictions because it ensures that they can maintain roads that are used by heavy commercial vehicles.

Licenses need to be renewed every year. You’re also required to file reports every quarter, even if you didn’t operate outside your home state.

It’s also important to know that the agreement pertains not to drivers, but to trucks or power units.

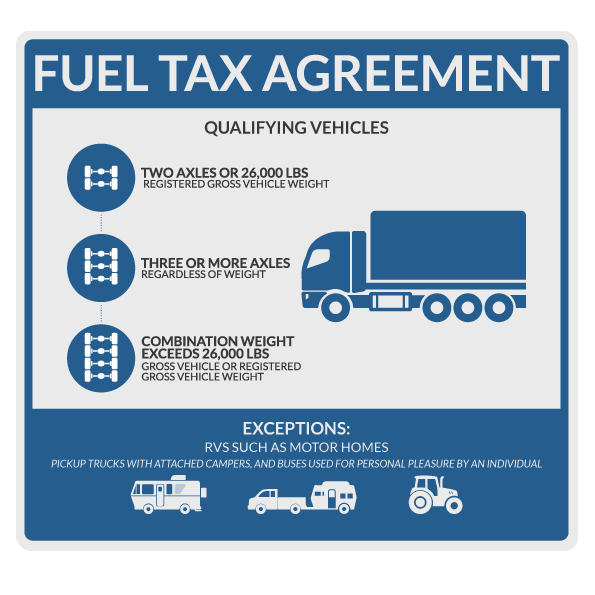

What Vehicles are Covered?

The graphic below shows what vehicles fall under the specifications.

How Do Truckers Track Their Miles?

Two common ways to track mileage for the fuel tax agreement are using smartphone apps and trip sheets. We’re all familiar with apps by this point, so this is pretty easy for many qualified motor vehicle operators. Of course, with all the moving parts, it’s important to enter as much information as possible.

Trip sheets are a bit of a throwback to the past era of long-haul trucking and it’s exactly what it sounds like. The driver enters information manually into the right fields. Of course, there’s an electronic version because this is the 21st century. Regardless of whether they’re paper or digital, trip sheets definitely increase the risk of errors versus more modern methods that take the final calculations out of the drivers’ hands.

Telematics: A Multi-Pronged Way to Simplify Reporting

Telematics is a system of moving data over long distances. GPS tracking is a great example and today’s solutions go beyond vehicle tracking. Fleet managers use telematics devices to devise strategies for cutting fuel costs, reducing labor costs, improving fleet safety, and enhancing customer service.

Today’s solutions share information on a wide range of vehicles, and they track an amazing array of data. Our solution can even track the individual temperatures of refrigerated trailers, and notify fleet managers of any fluctuations that could spoil the products en route.

Using a fleet telematics solution can simplify IFTA reporting even further. Telematics can report driver and vehicle information, location, date and time, and even the number of gallons consumed. Motor carriers and commercial motor vehicle operators will be able to identify miles driven in each state by vehicle, along with the total cost of fuel and amount of fuel used.

So the driver has to do nothing but drive and the back office staff in just a couple clicks can pull the scheduled or on-demand report. That will cut down on paperwork time while increasing the accuracy of your reports.

Many trucks are equipped with telematics devices already. Electronic Logging Devices (ELDs) are common in the cabs of many fleet vehicles, so your simpler solution to mileage tracking might be ready to go. Of course, not all ELDs log the data necessary to help with the fuel tax agreement. That’s an important point if you’re trying to get the most from all of your devices. Some services may only retain data for 6 months, well short of the 4-year requirement.

How GPS Insight Can Help

Saving time and money drives many companies to use telematics devices. Of course, time is money in virtually every business. Telematics solutions save time in a number of ways:

- Improving routing

- Reducing idle times

- Automating mileage logs

- Simplifying compliance

- Tracking maintenance

Combine this with the State Mileage report, which is one of the many reports that can be pulled from the GPS Insight solution. The state mileage report compiles the necessary fuel tax data. It saves time for drivers and back-office personnel.

Here’s What IFTA Requires

What do you need to do? The first step is filling out an application. You’ll have to apply through your base jurisdiction or base state to get the process started. This applies to owners or operators of a Qualified Motor Vehicle that travels between two or more jurisdictions in the United States or Canada. QMVs have two axels with a gross vehicle weight of over 26,0000 lbs, possess 3 or more axels, or a combination of the two.

From there, you’ll have to keep an official IFTA decal or sticker on your truck at all times. You’ll have to submit a completed report every 90 days, as well as pay all IFTA taxes due by the deadlines.

You’ll also have to keep your history up to date: The fuel tax agreement requires that drivers maintain all fuel tax records for at least four years. And your office will need to have the records on hand at times. You’ll also need to provide DMV auditors with access to your records upon request.

Audits are Part of Life

FTA jurisdictions agree to audit 3% of licensees each year. Even if you’ve followed all the guidelines to the letter, you could face an audit.

Quite a few of the audits result in fines, too. In Canada, provinces penalized 49-95% of their licensees. What was the cause of the fines? Bad record-keeping, late filings, and inaccurate data.

If you’re using a GPS solution, being able to produce individual trip reports can verify four distance calculations. That, in turn, will lessen the odds of a fine.

Accuracy Matters for Reporting

With all the jurisdictions trucks move through, it’s easy to see how manual reporting could be less accurate. So how can you run afoul of the fuel tax agreement, and what sort of penalties could you face?

Any number of discrepancies could trigger a penalty, including odometer issues; not recording personal miles; inaccurate information; filing late; and not filing at all.

Filing false returns can even be criminal offenses. There are also civil violations that can trigger fines in excess of $1,000.

Late reports incur a penalty of $50 or 10% of the quarter’s net tax liability, which is greater. Drivers and organizations face interest on all delinquent taxes due to each jurisdiction at the rate of 1% per month.

All this can add up, so it makes sense to use any devices or programs that can ensure that you pay your fuel taxes accurately and on time.

There are also other potential fines and penalties. It’s best to check the fuel tax agreement information web pages of the jurisdictions where you’ll operate.

What are the Reporting Periods?

The fuel tax agreement requires licensees to report every quarter. The periods are:

- January to March (Reports due April 30)

- April to June (Reports due July 31)

- July to September (Reports due Oct. 31)

- October to December (Reports due Jan. 31)

Worst-Case Scenario for a License

Aside from fines, it’s also possible for IFTA members to completely lose their fuel tax agreement license. Usually, licenses are revoked for not paying taxes, not filing fuel tax reports, or failing to comply with the agreement’s record-keeping requirements.

Again, this is where technology can keep your operations in order. When accuracy and time matter, it’s best to have a fleet management solution on your side.

Are There Any Alternatives?

It’s still possible to purchase temporary fuel permits. While it’s much more of a hassle than opting for the IFTA license, it’s still far more efficient than it used to be. It’s now possible to order permits online. That’s a huge time saver versus stopping at individual state entry ports before the Internet age. Book a demo to learn how we make IFTA reporting a breeze!

Get a Demo

Ready to see how GPS Insight can help simplify your IFTA reporting?