Choosing the Best Dash Cam for Commercial Vehicles: A Comparative Guide

As a fleet manager, you want to feel like you’re in the passenger seat with your drivers.

- You get falsely accused of accidents you didn’t cause.

- You have a lot of false reports that you can’t argue against.

- You have had litigation issues in which you couldn’t defend your driver.

- You are looking for a way to ensure your drivers are following policy and staying safe

If you’re searching for the best commercial vehicle dash cam, chances are you need help. However, the critical question for fleet managers remains: which dash cams are worth the investment?

With the vast options available, we’ve taken the time to research the best three on the market that will suit your needs.

#1 GPS Insight: Best in Class

When it comes to the combination of tracking your fleet vehicles and using high-definition video recordings, GPS Insight stands out above the rest. While we may be biased, we think the benefits speak for themselves.

Pros:

- GPS Insight provides a powerful yet user-friendly dash cam solution The system offers not only critical safety features but also advanced driver coaching capabilities, incentivizing courteous driving.

- This comprehensive solution comes at a competitive price point, making it accessible for businesses of all sizes.

- The support and guidance offered by GPS Insight can enhance the overall user experience and ensure results.

- A U.S.-based customer support system.

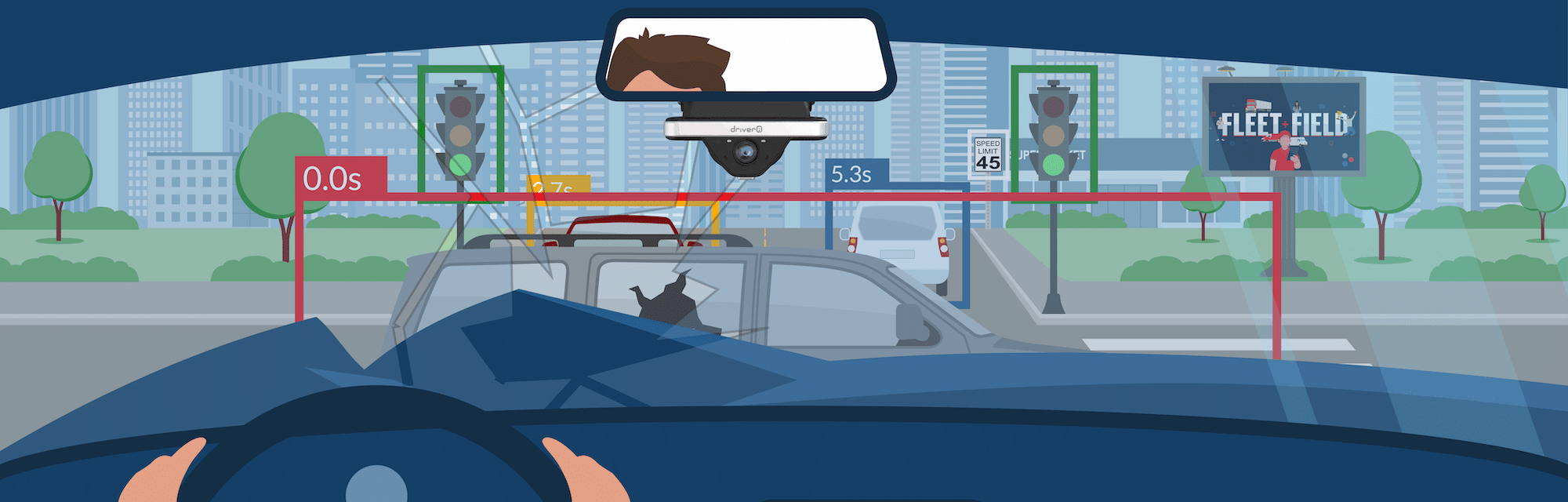

- State-of-the-art AI camera ensuring better driver behavior on a wide-angle lens.

Cons:

- Sometimes there are delays when it comes to updating the dash cam software.

The Best Dash Cam For Your Fleet: GPS Insight

While Samsara and Verizon Connect offer compelling dash cam options, GPS Insight stands out as the superior choice for several reasons:

- GPS Insight combines cutting-edge technology with user-friendly design, ensuring an effective yet accessible solution.

- Our smart camera offers advanced driver coaching features, aligning to promote safer and more courteous driving.

- GPS Insight’s competitive pricing means you don’t have to break the bank to enjoy a top-quality dash cam system.

- The dedicated support and guidance provided by GPS Insight ensure you get the most out of your investment.

- We’re not here to upsell you. GPS Insight has many options for dash cams to meet the needs of your fleet and sometimes the more affordable option is the best fit.

The decision to invest in a dashcam system should focus on results, support, and cost-effectiveness. While Samsara and Verizon Connect offer solid choices, GPS Insight takes the lead with an affordable yet feature-rich solution that’s designed to enhance the safety and efficiency of your fleet.

Making the right choice for your commercial vehicles starts with choosing the right dash cam system, and GPS Insight is here to lead the way.

#2 Samsara: A Solid Contender in Video Quality

Like Verizon, Samsara boasts full HD video recording that has Wi-Fi connectivity. Samsara can be helpful with driver safety whether you’re a smaller or larger operation.

Pros:

- The Samsara CM-32 boasts an impressive AI system that automatically alerts fleet managers to triggering events, enhancing safety.

- These dash cameras record and store up to 40 hours of drive time, ensuring critical footage is retained.

- Its functionality can help fleet managers effectively monitor and improve driver behavior and safe driving.

Cons:

- The Samsara CM-32 comes with a price tag of $399, plus an annual license fee of $600.

- For budget-conscious buyers, this solution might not be the most cost-effective choice.

- Customers have complained the customer service has not been as helpful as they would have hoped, especially for the price they’re paying.

- Customers have said, that while you think you’re getting a lot of bells and whistles for what you’re paying for, you end up only getting half of that offer.

- They increase your rates upon renewal even if you’re canceling extra features.

- Their support team was recently outsourced which has made communication difficult for fleet managers trying to solve problems.

Samsara is one of the bigger names out there and certainly has earned its title with how many units they’ve sold in their time. While this is exciting for them, it has impacted how fast they’re able to respond to their customer’s needs.

#3 Verizon Connect: In-Cab Camera Systems

Verizon Connect has been a great contender for fleets wanting to record in real-time and utilizes a cloud-based solution as opposed to having to rely on an SD card.

Pros:

- Verizon Connect offers a comprehensive fleet management solution, encompassing various telematics features, including dash cams.

- The system’s extensive functionality provides a holistic view of fleet operations and performance.

- Real-time tracking and analytics offer valuable insights into your fleet’s activities.

- Wifi enabled dash cameras for easier use.

Cons:

- Verizon Connect may be seen as a more complex solution, which could be overwhelming for those seeking a straightforward dash cam option.

- Pricing and contract details may vary, potentially requiring significant commitment.

- Onboarding can be a hassle. Be prepared for long hold times if you have issues getting set up.

- Their system is best used for fleets with semi trucks rather than commercial vehicle fleets.

- Former customers have complained they’ve had to wait up to 3.5 weeks before they saw results. Other companies — like GPS Insight — can get back to you in mere minutes.

Ultimately we placed Verizon at the bottom of our list because while their features work well for high-quality, real-time tracking, it can be difficult to get set up.

We all know Verizon for its multitude of other products, which means they’re very busy. Because of this, Verizon Connect is less than 1% of Verizon’s business which is proportional to how much time they spend on fleet accounts. This of course is an obvious obstruction to your business’s growth especially if you want to implement video recording as soon as possible.

Why should I consider a Commercial Dash Cam?

As a fleet manager, you’re probably coming across situations where your fleet is blamed for things they may or may not have done.

Whether it’s about driver behavior, not showing up to a job or an insurance claim, it’s their word versus yours if you don’t have dash cam footage to protect you.

Cameras are not just for front-facing situations but can also be set up to be dual-facing as well. When implemented correctly, fleet managers can use the playback feature to recognize any unsafe behavior and use that to coach and improve driver behavior.

Having access to recorded footage can be a fleet manager’s best friend. Whether you access it from a micro SD card or similar memory card, cloud storage, or a loop recording, you can check to see how well your fleet is — or is not — doing on the road and protect yourself from false claims.

The fleet vehicle dash cam market is a testament to the growing realization among fleet safety managers that in-vehicle cameras are effective tools for safeguarding their drivers. The first step to safety is being able to receive notifications about the driving behavior of your fleet and understand what needs to be corrected.

When you don’t have the opportunity to look after yourself, it helps to have a camera with essential features like motion detection — to look out while your car is parked —, a solid viewing angle, and recording at 30fps or better.

However, the critical question for fleet managers remains: which dash cams are genuinely worth the investment?

Whether working with large fleets with hundreds of truck drivers or a smaller operation, being able to track fleet behavior can give you a better perspective on how your investments are being treated and even help lower premiums from the insurance companies.

If you’re interested in joining the thousands of successful fleet managers who have partnered with GPS Insight, click here for a free quote and demo to get started.

Get a Price Quote

Ready to see how GPS Insight Telematics can work for your fleet?