Forget FICO – Do You Know Your Fleet’s Risk Score?

If only the same could be said for determining other premiums in one’s life.

Enter in the Fleet Risk Score

Especially when it comes to auto and fleet insurance, there is no standardized scale for rating a commercial fleet’s level of risk and determining its insurance premium. Insurance agents will typically execute discretionary pricing when evaluating a business or fleet to determine eligibility and premiums. The loss rating determines the premium needed to cover predicted losses based on the company or employees’ past performance. The discretionary aspect can go either way – higher or lower, depending on the insurance provider’s qualitative factors and severity of past claims. A big part of this is also the underwriter’s perception of the risk based on their evaluation of the safety culture, written programs, training, management commitment to safety, etc.

Most metrics that underwriters rely on are focused on a driver’s record and past behaviors and performance using a tool with current performance indicators. Based on these metrics, below are some of the factors insurance carriers consider when determining coverage eligibility:

Number of Drivers

Average Miles Driven Per Day

Moving Violations

Personal Credit Score of the Drivers

Claims Per $100K in Premium

Investing in Safety

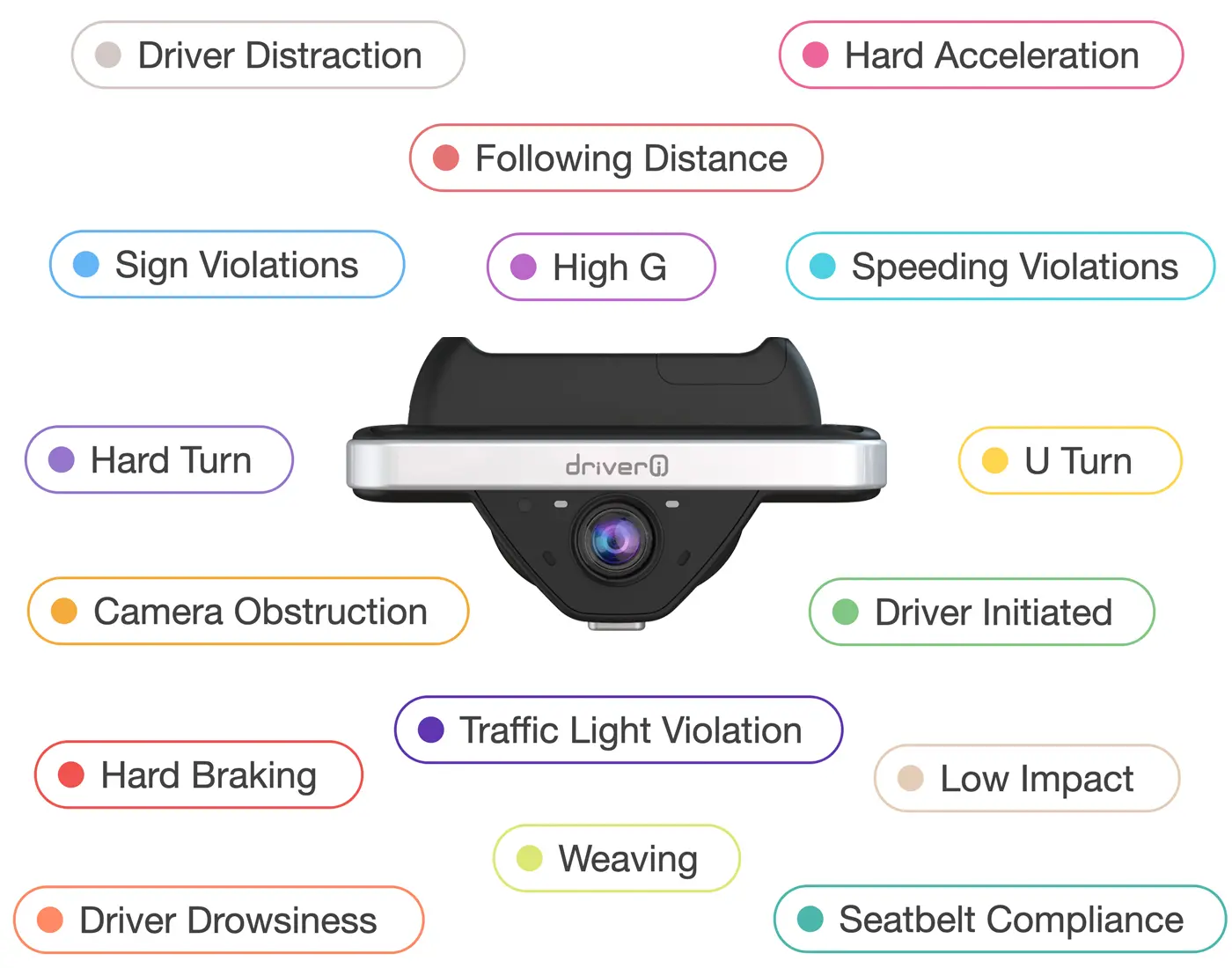

A critical factor also taken into consideration is preventative measures fleet managers use to offset risk, such as telematics. It is important to note that conventional telematics is no longer the answer to risk management. Many fleets are looking to video telematics, like smart dashcams, to track driver behavior and the behavior of other drivers on the road, which can save a fleet millions of dollars in fraudulent lawsuits and insurance scams.

In For the Long Haul

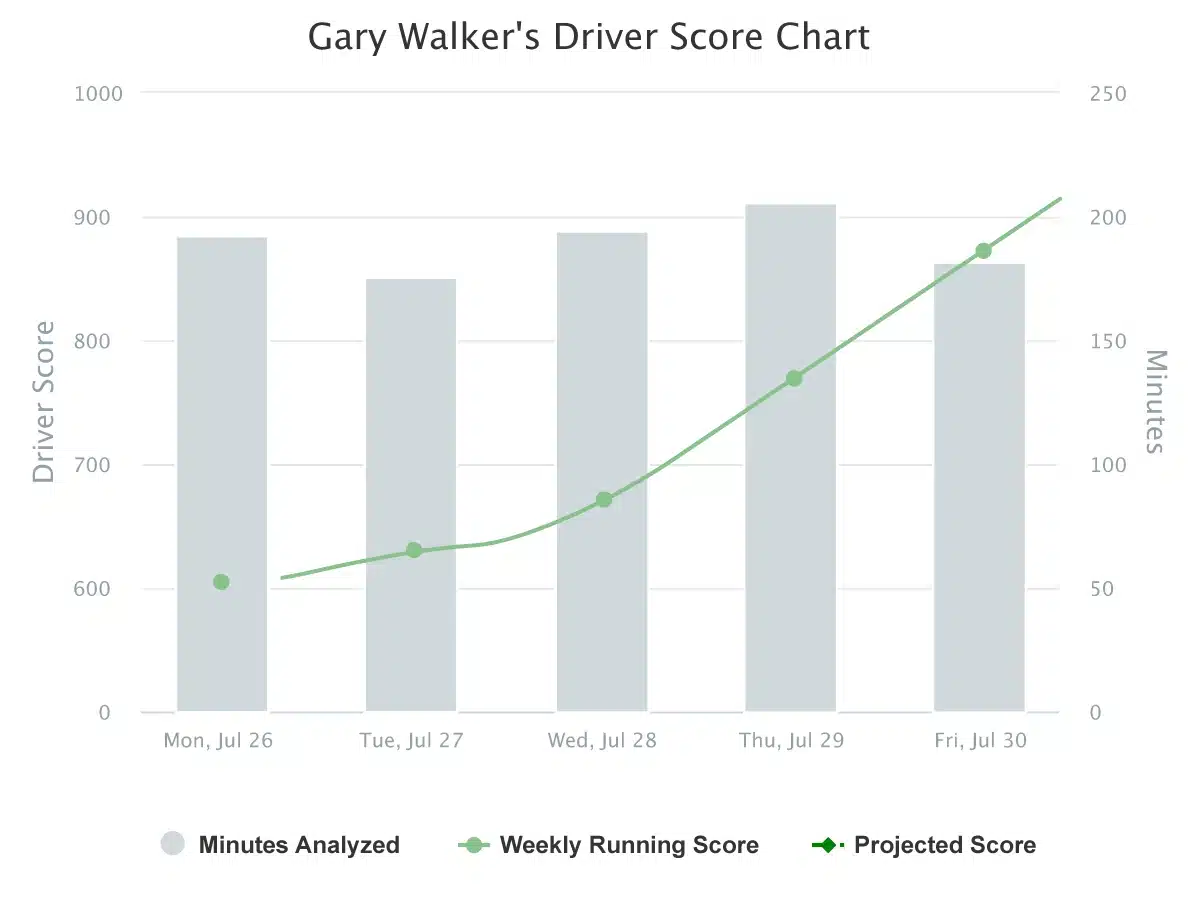

Fleet managers can expect to spend up to two years working on driver training and using video telematics to supply underwriters with evidence to make their case for lower premiums. While it can be a hassle, it is time well spent when the reward is enhanced driver safety and reduced cost of claims and unexpected business disruptions. Using scorecard data to showcase a two-year improvement shows the fleet’s level of commitment to safety and sustained commitment to lowering incidents.

Most metrics that underwriting uses is reflexive, looking at past behaviors such as MVRs or past claims. Using a tool with indicators of current performance shows that you are actively engaging current behaviors before an accident or driving violation can occur.

If you don’t have two years of scorecard data, demonstrate a strategic approach. Show what issues your fleet and drivers had – then show how you benchmarked the fleet’s performance, what behaviors you’re measuring, what policies you’ve put in place, how you’re coaching drivers, and what your results are so far.

You’re In the Green

By investing in safety and incorporating emerging technologies into the daily business acumen, fleet operations can cement the appeal of their predominantly high-exposure workforce to insurance carriers. Additionally, by generating robust data, businesses can persuade insurers that they deserve adequate insurance premiums that don’t empty their wallets or decimate profit margins. When it comes time to renew an insurance policy, leaders should present their safety data and showcase improvement. Ultimately, improving health and safety measures is the only way to reduce insurance premiums, reduce or eliminate driver risks, and ensure business continuity.